Switch to private health insurance PHI

1. basic needs analysis:

Is private health insurance the right step?

Before we consider switching to private health insurance, we will check together whether supplementary insurance would be sufficient for you. You can often close many gaps in your statutory health insurance (SHI) with special supplementary insurance. Our analysis aims to identify the advantages and weaknesses of your current cover and to show you whether a switch to private health insurance is really necessary. Only if you know your personal gaps can you improve them in a targeted manner.

2. verification of insurance eligibility:

Who can switch to private health insurance?

Access to private health insurance is reserved for certain groups of people. Together we will check whether you meet the requirements to take out private insurance. These groups include:

3. definition of the most important services

What cover for you & your family 💡

The next step is an individual analysis of your wishes and requirements. We discuss the current and future needs of your family with you and show you which benefits are really important in your situation. These include

We help you to get a comprehensive picture of which cover offers you the best benefits and develop a future-oriented strategy.

4. health issues and medical records:

The basis of your private health insurance 📋

4.1 Importance of the health questions

- The answers to the health questions are crucial as they influence the premium amount and the conditions of admission to private health insurance. Incomplete or incorrect information can later lead to a denial of benefits or even termination.

4.2 Correct and complete information

- To ensure that all health questions are answered completely and accurately, it is important to keep track of your most recent medical visits and diagnoses. This will help you avoid unpleasant surprises in the event of a claim and ensure you are optimally covered.

4.3 Requesting the medical file in case of uncertainty

- If you are unsure whether you have been to the doctor in the last three years or what diagnoses have been made, it is advisable to request the medical records from your health insurance company. Many health insurance companies, such as Techniker Krankenkasse, offer this option in their app - often just a click away. This gives you a precise overview and you can be sure that the health questions are answered correctly.

5. future planning

Long-term premium security & old-age provisions 💶📈

Private health insurance can become more expensive as you get older, and old-age provisions are crucial to ensure that your cover remains affordable. We take care to recommend tariffs with stable premium trends and explain the importance of provisions to you. In this way, you can already make a contribution today to cushion rising costs in old age.

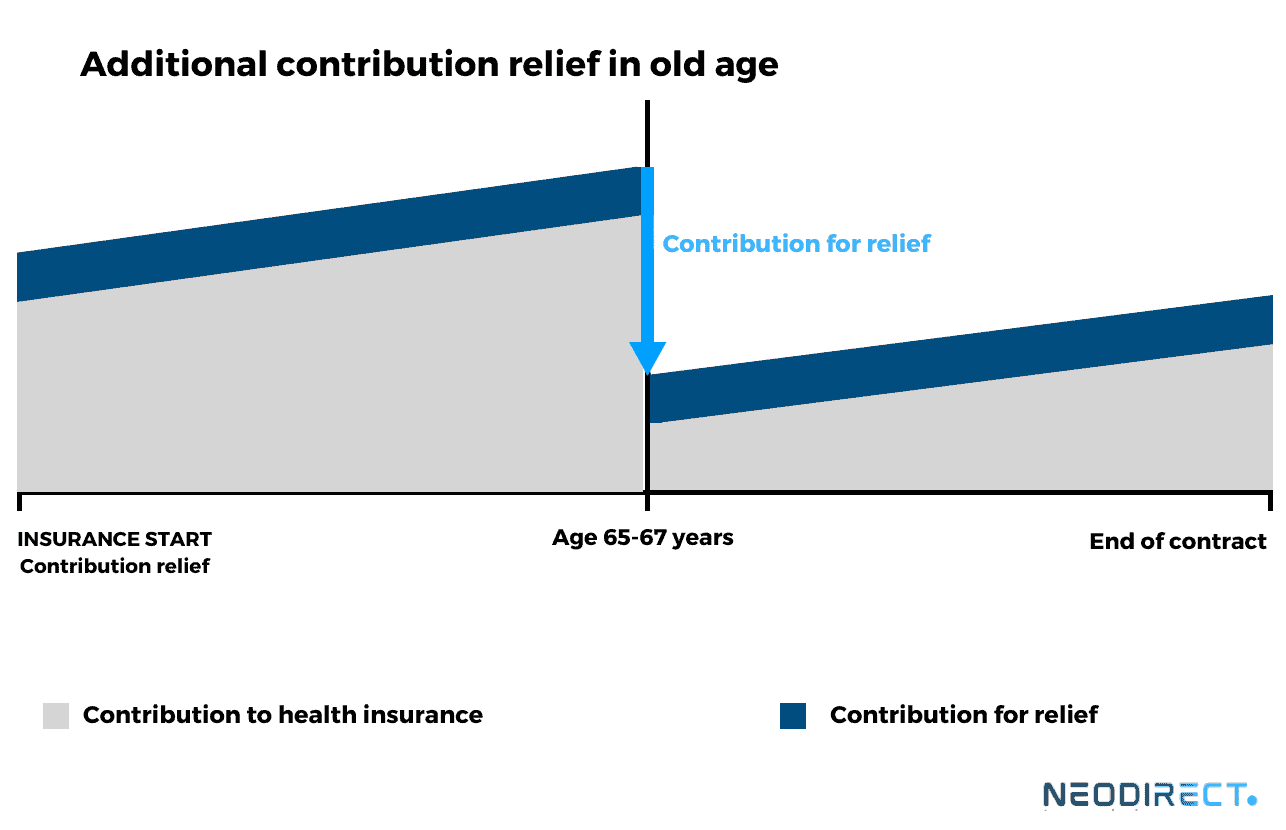

Additional tip: For even better protection in old age, it is possible to include a premium relief tariff in your private health insurance. This tariff allows you to make a small additional contribution when you are younger, which can later be used to reduce your private health insurance premiums in retirement. This keeps costs more stable and calculable in old age.

6. decision

Comparison & individual advice 🤝

As independent insurance brokers, we compare various private health insurance tariffs and providers to show you the best options. With us, you receive transparent and independent advice that is tailored to your specific needs. Expert advice is essential, especially if you have health restrictions or special requirements.