Improving Your Insurance Journey

Our insurance services ensure your policies are up-to-date and meet your needs. We offer easy contract transfers and free policy reviews to help you understand your coverage and find improvements. Our personalized support covers all your insurance needs, making the process hassle-free and giving you peace of mind.

1. Sign Up as a New Customer

Firstly, please proceed with your registration on our website by clicking on the "New Customer Registration" link. This step is very important, especially if we first connect over the phone, to ensure your email address and name are accurately recorded and avoid any potential misunderstandings.

You can skip this step if you already have an account with us. However, if you accidentally create multiple accounts, don't worry. We can easily merge them for you—contact us for assistance.

The app is also available for your smartphone; you can use the same login details for web access. However, for steps two through seven, we recommend using a PC, laptop, or tablet to manage your contracts via the web interface.

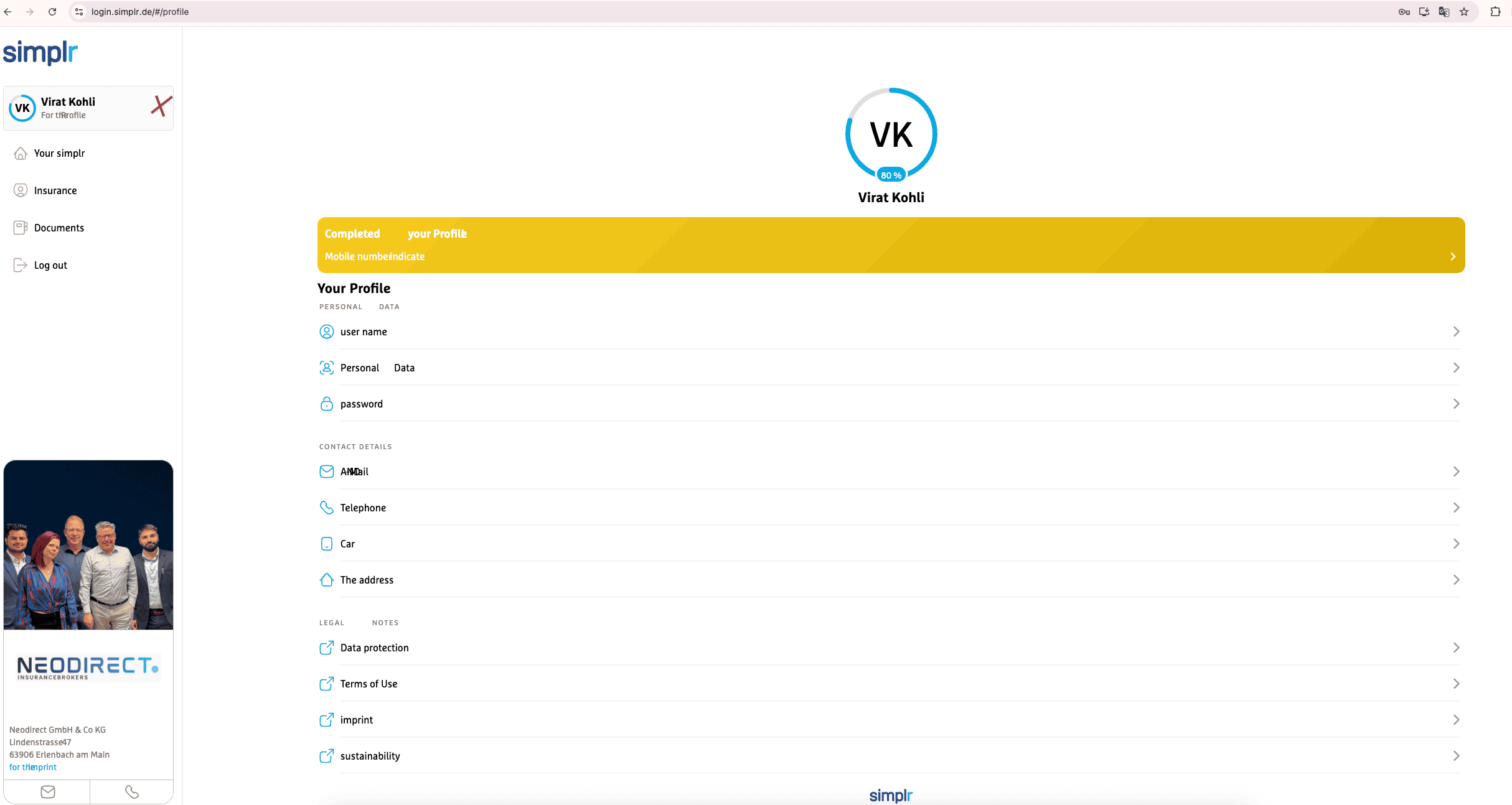

2. Complete Your Profile in the Dashboard

Next, please fill in missing details such as your primary residence and date of birth. You can add additional addresses, like a secondary residence, under "Add Address." Adding other contact information, such as business email or website links, is also possible. If adding multiple private email addresses, you can specify a preferred one for receiving updates about new documents.

Activating the data service ensures that all your insurance contract details are up-to-date.

You can either sign directly in the app or confirm via SMS for any changes or updates you'd like to make, including activation.

For the best experience, use the Google Chrome browser.

Step 3: Register Your Contracts

To add your existing contract, go to the "Contracts" tab in the navigation menu. Enter your contract details accurately, especially the insurance policy number. You can also add extra information like payment details or insurance start date.

Once done, your contract will be integrated into the Simplr platform. Repeat the process for more contracts, ensuring you only add those where you are the policyholder. Each policyholder needs their own account.

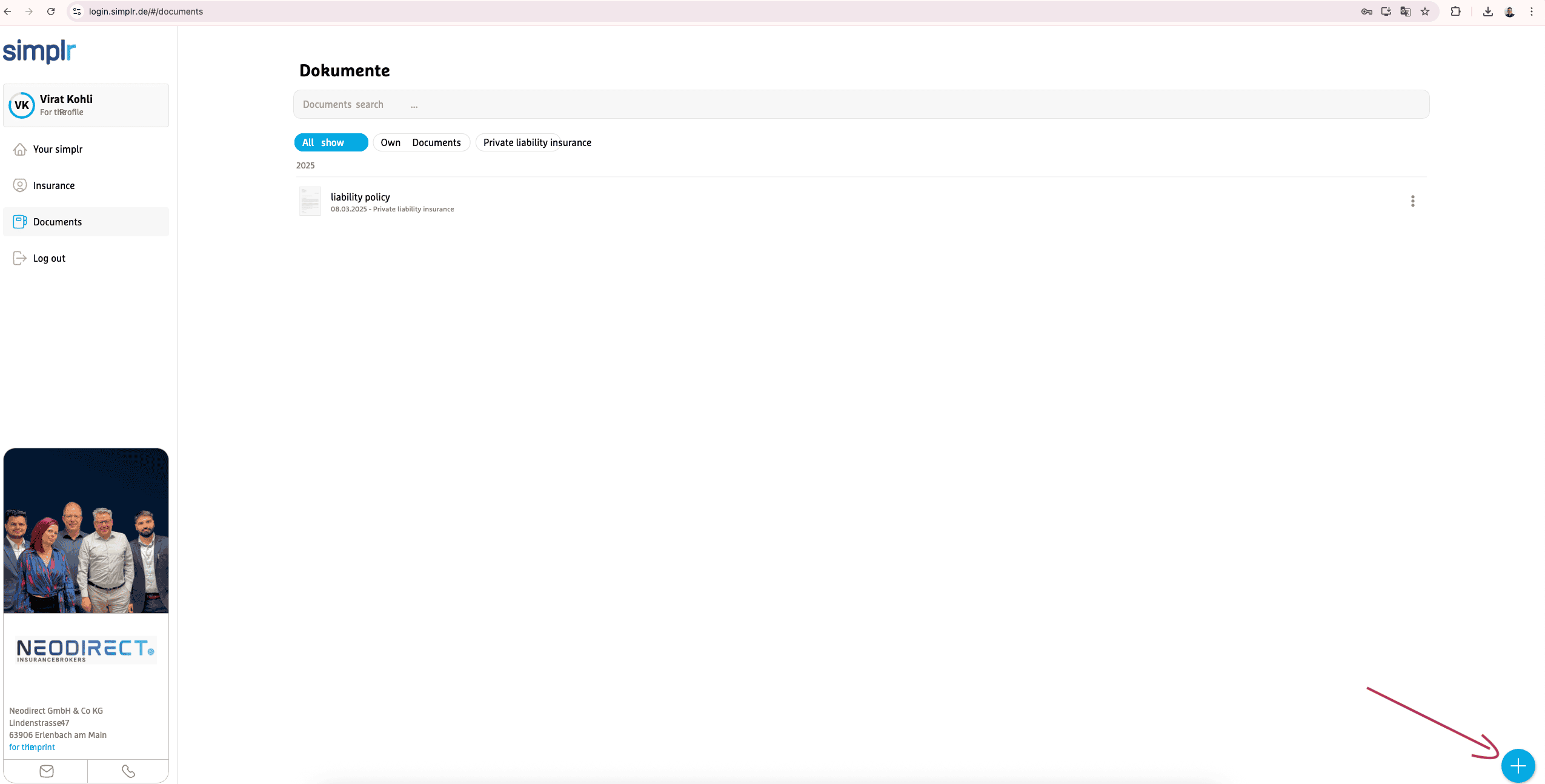

4. Insurance Document Upload

After Step 3, upload your insurance documents in the "Documents" section by clicking "Upload File." Name your files clearly (e.g., "Premium Invoice 2021") to avoid confusion.

Before uploading, merge all pages of a document on the same topic into one file. For example, combine a five-page insurance certificate into a single file to make it easier to manage and access on Simplr.

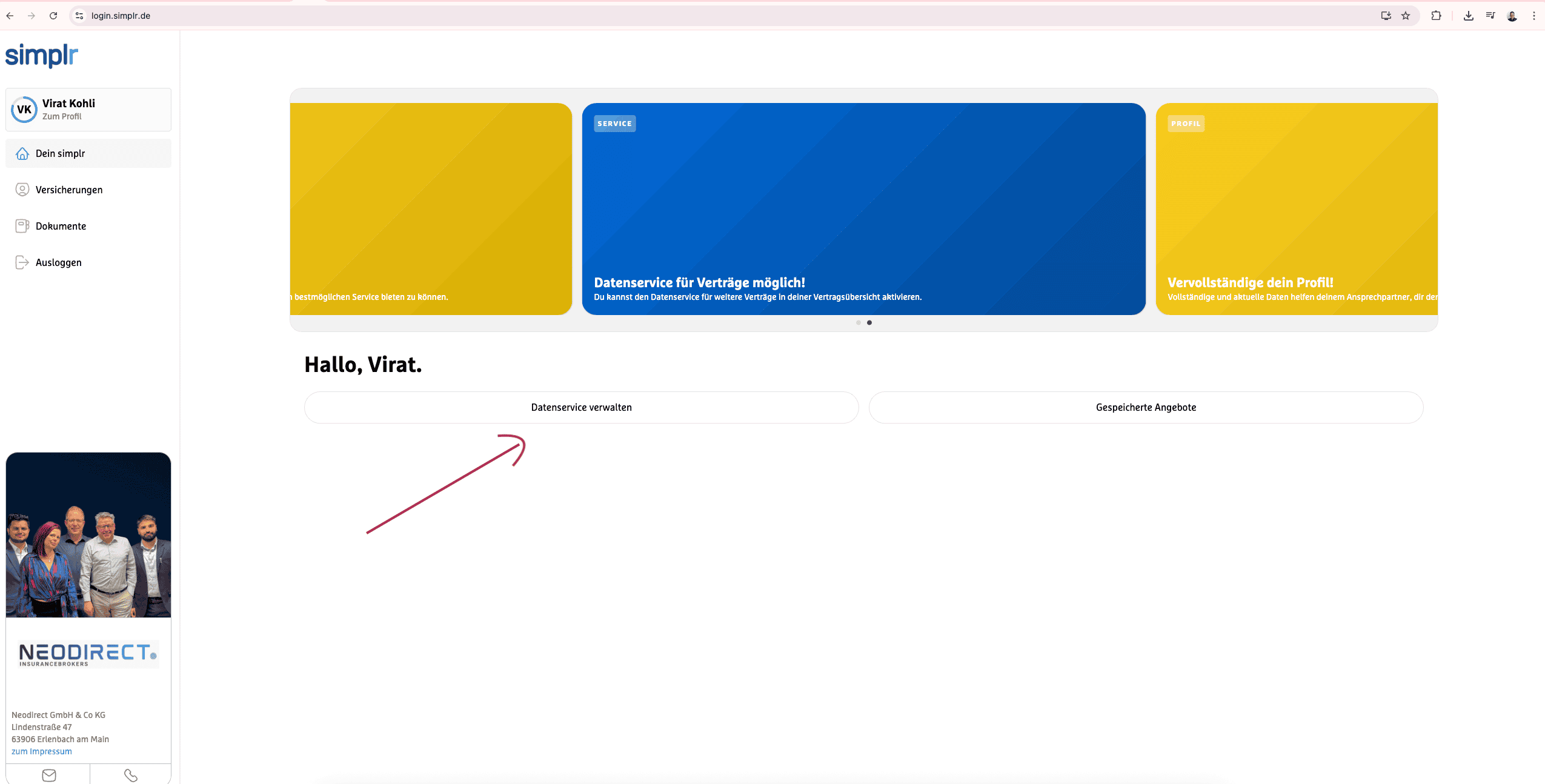

5. Activate Contract Maintenance

Activate contract maintenance to keep your contributions up-to-date and automatically upload documents to your cloud. Simply go to "Data Service administration". Confirm to let us manage your contract data, and ensure you enter your insurance policy number correctly. Avoid activation if canceling contracts due to poor service or high costs. This service offers a comprehensive view of your insurance policies.

6. All Set and Ready to Go – Reach Out Now!

Have you reached out to us yet? Contact us now to let us know if you want us to manage your data. Whether you're satisfied with your current insurance or considering a change, we're here to help. All document exchanges, including comparisons, offers, and applications, will be efficiently handled through Simplr for your convenience. You'll also receive an automatic email when an offer is ready for your review.

A final note:

Since not all insurance companies collaborate with insurance brokers, we cannot manage all contracts. In such cases, data won't be updated, nor will documents be uploaded.

Moreover, we can't activate data maintenance for contracts with certain insurers like Aachen Münchener (now Generali), Debeka, HUK-Coburg, and WGV. This often leads to discrepancies in property insurance value.

We're committed to helping you make well-informed choices by offering a comprehensive comparison of your insurance contracts. However, we reserve the right not to manage contracts with notable coverage gaps for your best interest, even if they are more cost-effective. Our priority is ensuring optimal coverage, as inadequate coverage in the event of a claim is disadvantageous for both parties.