Comprehensive Accident Coverage for Cricket Players

Cricket is a dynamic and demanding sport that requires both physical fitness and skill. However, even seasoned players are not immune to injuries. Common injuries in cricket include muscle strains, fractures, and head injuries.

Why Do Cricket Players Need Specialized Accident Insurance?

While statutory accident insurance typically covers accidents that occur during work or school activities, it often does not include accidents that happen during leisure activities, such as playing cricket. A private accident insurance policy offers comprehensive protection, safeguarding you against the financial consequences of sports-related accidents.

Example: Insurance Sum €100,000

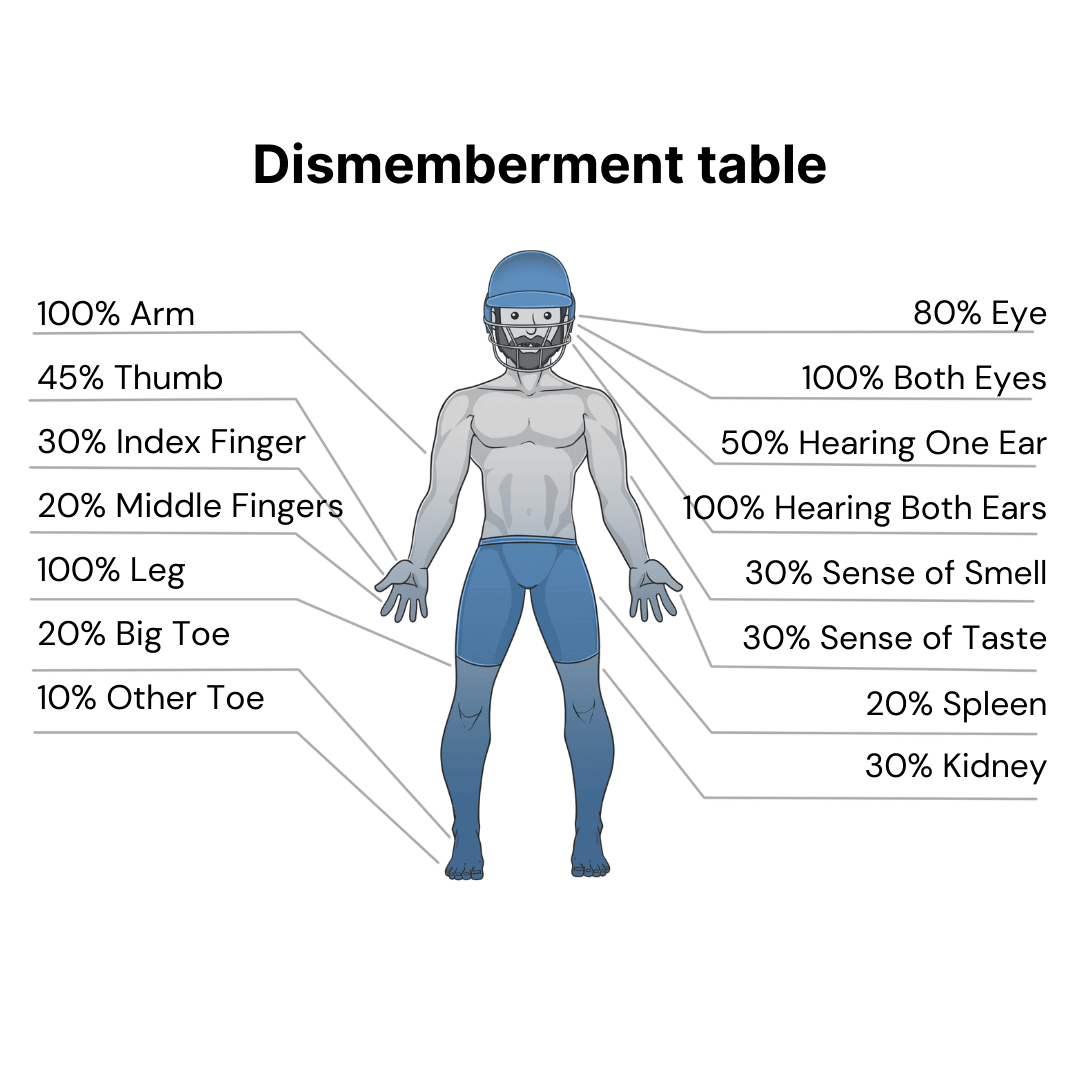

The following table illustrates the benefits payable at various degrees of disability, both with and without progression:

| Degree of Disability | Benefit without Progression | Benefit with 225% Progression | Benefit with 500% Progression | Benefit with 1,000% Progression |

|---|---|---|---|---|

| 25% | €25,000 | €25,000 | €25,000 | €25,000 |

| 50% | €50,000 | €112,500 | €250,000 | €500,000 |

| 75% | €75,000 | €168,750 | €375,000 | €750,000 |

| 100% | €100,000 | €225,000 | €500,000 | €1,000,000 |

With an agreed insurance sum of €100,000 and a 100% disability, the payout amounts are as follows, depending on the progression level:

225% Progression: €225,000

500% Progression: €500,000

1,000% Progression: €1,000,000

Subscribe to our newsletter

Move Parallel with us. Achieve your goals by consistently getting our latest updates. Always keep an eye on what we are doing by subscribing to our newsletter.